40+ does fed interest rate affect mortgages

Web According to the Mortgage Bankers Association the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances 647200. Looking For Reverse Mortgage Calculator.

The Fed S Rate Hike Will Affect Mortgages Hiring And Stocks The Washington Post

Web Todays mortgage interest rates are well below the highest annual average rate recorded by Freddie Mac.

. As of this writing in. Fed officials projected a federal funds rate of 19 by the end of 2022 meaning rates would rise six more times this year. This is the rate that banks and credit unions use to lend to each other overnight.

LendingTree Brings the Lenders To You So You Can Find Your Best Rate. Web The fed funds rate affects short-term loans such as credit card debt and adjustable-rate mortgages which unlike fixed-rate mortgages have a floating interest. Web In June the Fed raised interest rates by 075 percentage point its largest hike since 1994 in an effort to cool down the hottest inflation rate in 40 years.

Compare More Than Just Rates. 15-year mortgages are the. Web The Feds impact on interest rates.

Web In 2018 HUD lowered the interest rate floor from 5 to 3. Web The Fed doesnt actually set mortgage rates. Ad Understanding Reverse Mortgage And Its Calculation.

Web The Fed rate does affect the amount of funds banks have to lend though as well as how much banks must pay to borrow money. Ad Fill In One Simple Form Get Your Best Loan Offers For Your Needs. This rate is much higher than the 0 to 025 target it was aiming for in July 2021.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. However home loan rates often move in line with its. Web The FOMC has direct control over the federal funds rate which is the rate at which banks borrow from each other when they need funds overnight.

In 2022 the Fed acted aggressively to tame rising. Learn More About what an. In other words not your.

The impact of 2022s. A 500000 30-year fixed mortgage at a 7 interest rate translates to a monthly. Web The Feds current target for the federal funds rate is 15 to 175.

Web Web Federal Reserve raises interest rates by 025 Feb. Web Still mortgage rates have more than doubled since the beginning of the year. How the Federal Reserve affects.

Web This is the first rate rise since 2018. Compare More Than Just Rates. Find A Lender That Offers Great Service.

This rate typically has the most influence. Web The Fed raised its target for the federal funds rate by 025 or one-quarter of a percentage point. Web The FOMC controls one rate called Federal Funds.

15-year mortgages are the. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. When rates go up they can do so more.

To be clear up front the Federal Reserve doesnt set mortgage rates. Both couples bought 350000 houses with 20 down and 15-year fixed-rate mortgages. Find A Lender That Offers Great Service.

Web Increases of less than a percentage point can have a dramatic effect on borrowing particularly at higher loan amounts. Web The Federal Reserve is set to raise interest rates sharply this week a move that seems to portend higher mortgage rates. Instead it determines the federal funds rate which generally impacts short-term and variable adjustable interest.

Other interest rates are built atop the federal funds rate most. This means that all borrowers with expected rates over 3 now are receiving less money. Web Lets see how this plays out for two couples.

Interest rates for mortgages. Mortgage Rates And The Fed Funds Rate Updated 2023 No SNN Needed to Check Rates. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Web An interest rate hike will affect anyone with a home mortgage car loan savings account or money in the stock market. Web According to the Fed a 2 inflation rate is the sweet spot for maximum employment and price stability.

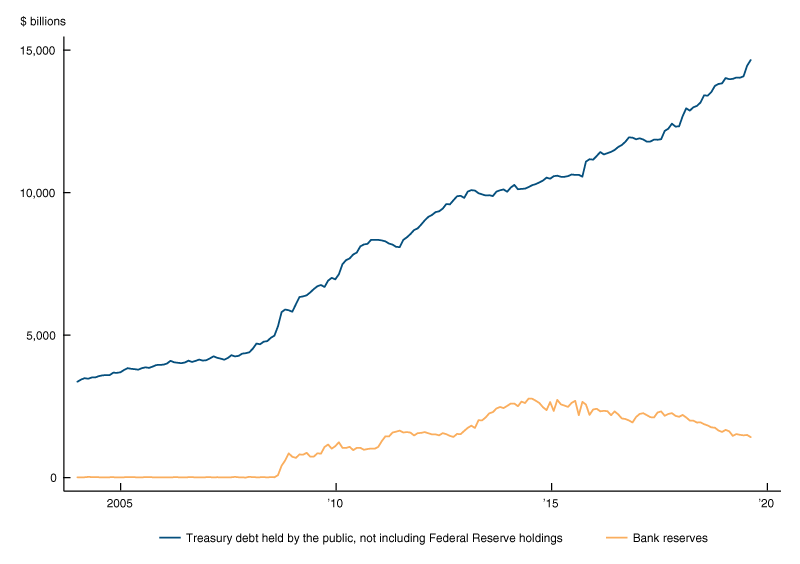

Understanding Recent Fluctuations In Short Term Interest Rates Federal Reserve Bank Of Chicago

Alfonso Peccatiello Auf Linkedin Markets Economy Centralbanks Earnings Money 57 Kommentare

How Will Mortgages Be Impacted By Fed Interest Rate Hikes

80 Of House Price Appreciation Since 1990 Was Due To Falling Mortgage Interest Rates

Rdp 2020 03 The Determinants Of Mortgage Defaults In Australia Evidence For The Double Trigger Hypothesis Rba

What Happens To Interest Rates During Stagflation Quora

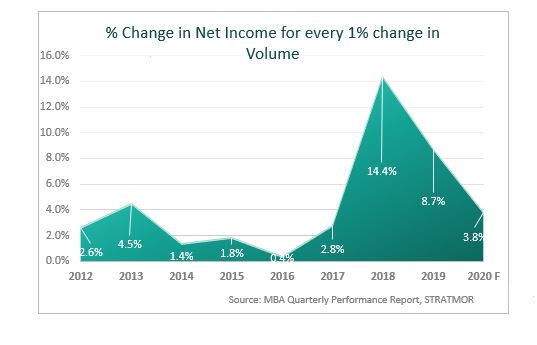

Bottle The Magic Three Lessons For Mortgage Lenders To Help Soften The Landing Stratmor Group

Will House Prices Fall If Interest Rates Climb Over 7 Quora

As The Fed Holds Rates Near Zero For Now What That Means For You

Daily Corona Virus Mortgage Updates Mortgage Broker Vancouver Bc Burnaby Bc Canada

15 Vs 30 Year Mortgage In An Infographic

Did The Fed Lower Interest Rates Too Much And For Too Long Federal Download Scientific Diagram

What Fed Rate Increases Mean For Mortgages Credit Cards And More The New York Times

It S Peak Mortgage Shock Time Interest Co Nz

How Does The Federal Reserve Impact Mortgage Rates Total Mortgage

Alfonso Peccatiello On Linkedin The Housing Market Is The Business Cycle And It S Painting A Grim Picture 36 Comments

What Does The Latest Fed Rate Hike Mean For Mortgage Rates